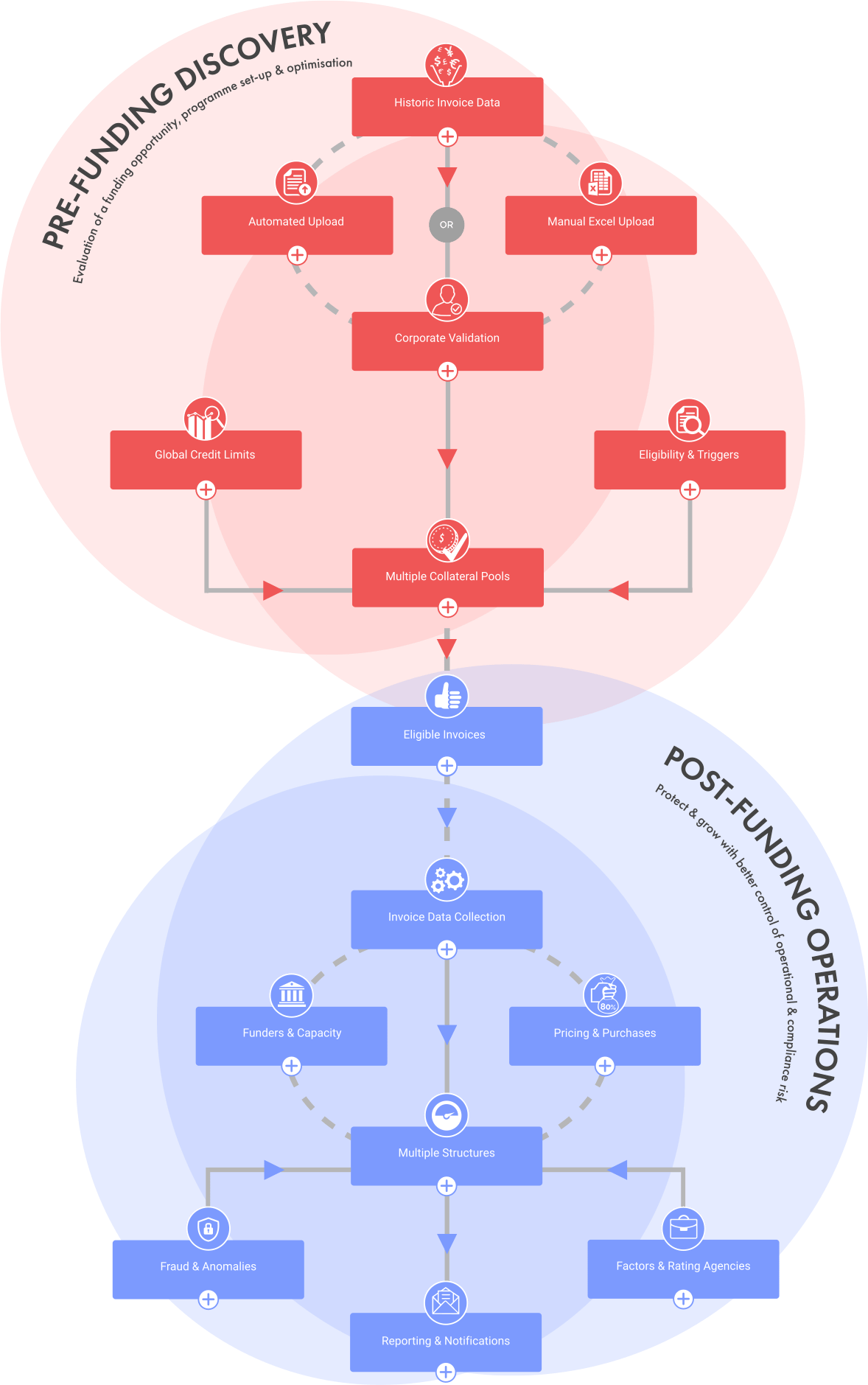

HOVER OVER THE STEPS BELOW FOR FURTHER DETAILS

Initial collection of granular historic invoice data required for credit performance analysis

Connecters automate the daily collection of invoice data & reduce operational overhead

Regular Excel based invoice data uploads are often used for smaller volume programmes

Corporate records are matched to Dun & Bradstreet for legal entity validation & group structures

Global credit limits calculated using trading experience or manually justified or supplied by underwriters

Optimisation of eligibility rules & programme triggers helps maximise the funding opportunity

Multiple collateral pools, each with different eligibility criteria, pricing and risk transfer strategies

Intra-daily calculation of eligible invoice pools available for purchase through the funding programme

Regular collection of granular invoice data required for efficient programme operation

Management of funding structures, notes, programme costs & funder integration

Purchase price calculations, optimisation of funding capacity & selection of which receivables to purchase

Receivables / payables purchases, true sale, borrowing bases, on/off balance sheet

Behavioural analysis identifies abnormal circumstances, optional automated repurchase strategies.

Programme specific or portfolio-wide reporting, alerting and movement analysis.

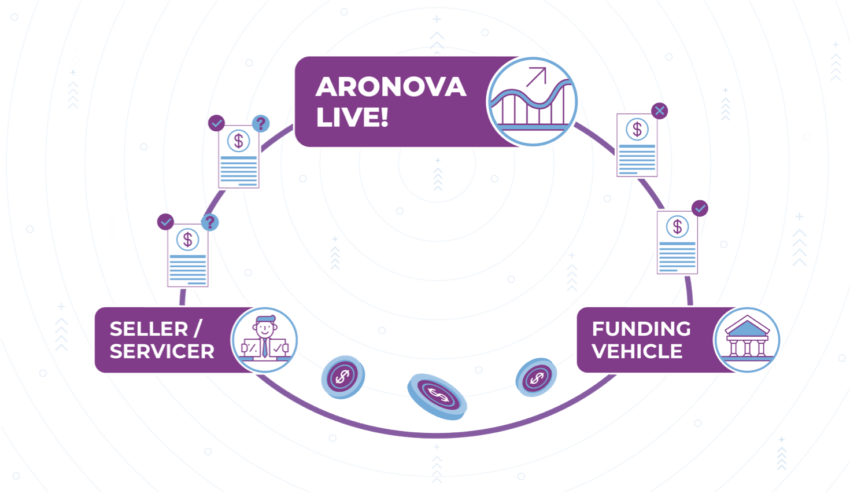

ARONOVALIVE! USES SECURE API CONNECTIONS TO AUTOMATICALLY SYNCHRONISE INVOICE AND PAYMENT DATA.

“Aronova have vastly improved the way we identify new opportunities. We can now see the performance of a potential transaction and its likely funding level within seconds of uploading a file of data.”

UK FUNDING PROVIDER