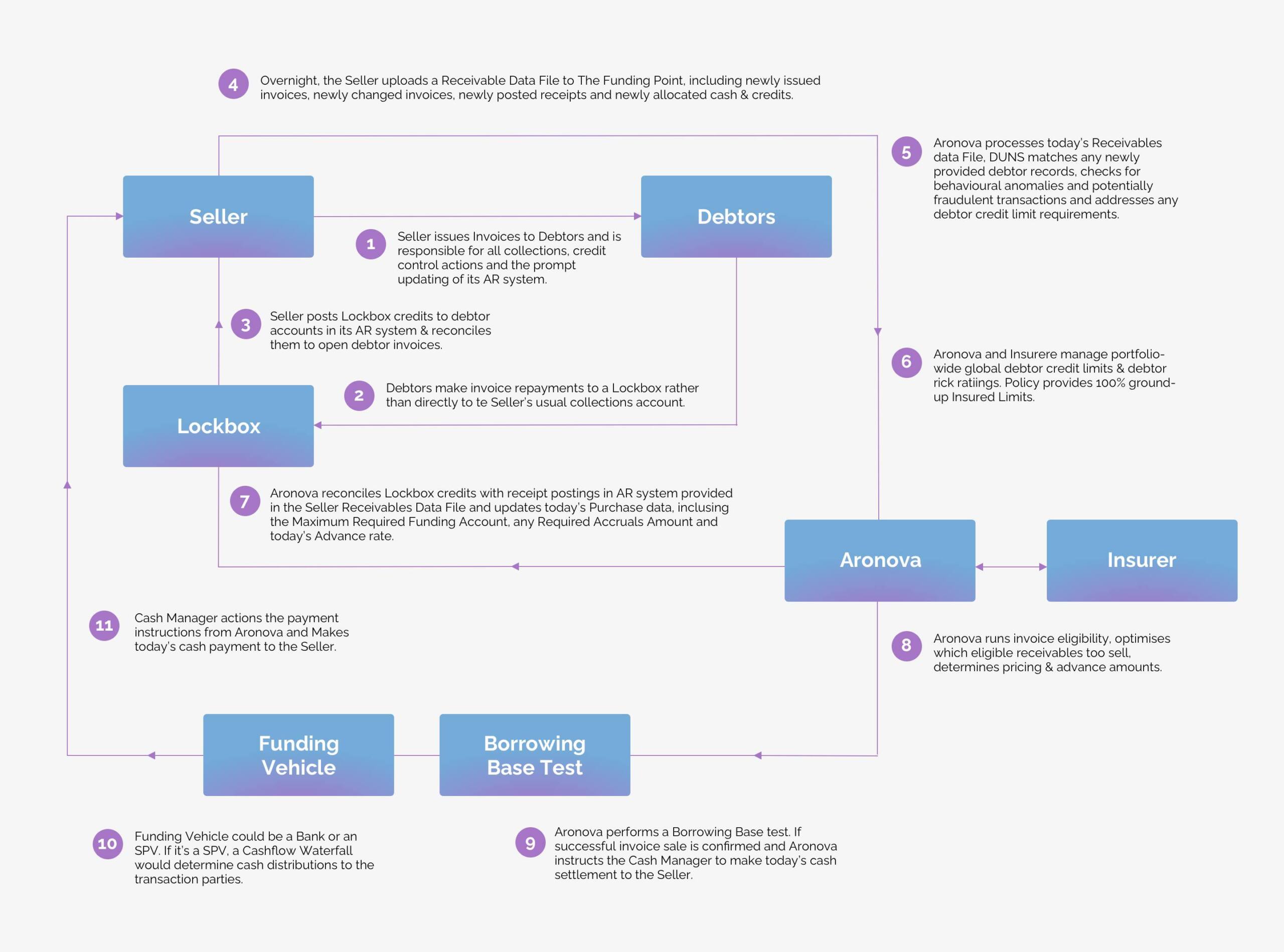

SPV-style receivables funding model

The following illustration tracks a typical receivables-backed working capital program, where the seller provides a daily file of receivables. A new pool of eligible receivables is generated each day and an advanced amount is paid when an eligible receivable is sold. A deferred amount is paid when a previously sold receivable is repaid.

In this example, the program manager controls the advance rate and today’s cash available for new purchases. Both of these will ultimately determine which eligible receivables can be sold. For a purchase to occur, the transaction must first pass a borrowing base test.